Airline & Hotel Input Tax Data Extraction

Input Tax Credit (ITC) is the backbone of GST regime. Airline travel and Hotel Stays are the big spends of corporates and availing input tax credit out of the numerous invoices that they receive has emerged as an important time bound activity. Our services of Input Tax Data Extraction is an automated solution for the laborious task.

HOW DO I CLAIM INPUT TAX CREDIT FOR AIRLINE SPEND?

- Airline Invoices from most of the carriers are received through emails, which are generally in pdf, html, eml and image formats.

- To claim input tax credit from airline spend, tax information are to be extracted from these airline invoices along with ticket number and invoice details. Manual process is slow and low on accuracy.

- Information extracted are to be presented in a meaningful excel format. Compare and match extracted data with tax returns (GSTR 2A) to ascertain proper tax credit.

- Invoices not easily readable; templates different for each airline; and also change from time to time.

- Corporates require an automated solution to extract data with ease and accuracy.

CHALLENGES OF CLAIMING INPUT TAX CREDIT FROM HOTEL SPEND

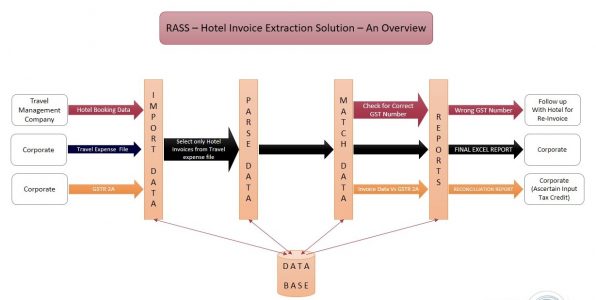

- Corporate employees file their travel expenses report on portals, through scanned copies of invoices.

- Scanned reports contain invoices of every spend like hotel stay, boarding, taxi bills, etc.

- Input tax credit is available only on hotel stay.

- Challenge faced by most corporates is to extract the input tax credit of only the hotel invoice among various other invoices scanned and filed together. Manual process is slow and low on accuracy.

- Information extracted are to be presented in a meaningful excel format. Compare and match extracted data with tax returns (GSTR 2A) to ascertain proper tax credit.

- Corporates require an automated solution to extract data with ease and accuracy.

THE SOLUTION

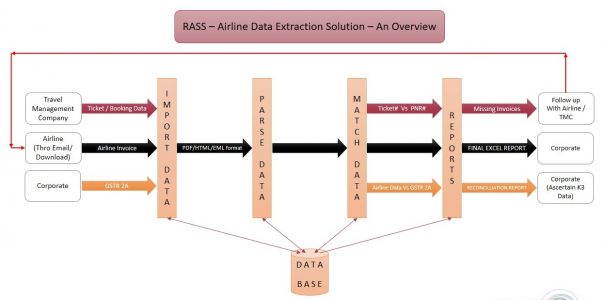

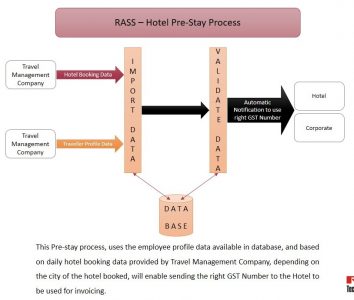

- Automated solution for extraction of data from airline invoices and travel expense reports. Automated process to handle high volume of data with minimum human intervention.

- The automated process employs Remote Process Automation for parsing of invoice files and extract the identified key data of the invoices.

- Performs basic validation for correctness and accuracy of extracted data and then stored onto a database.

- Customised Excel outputs are provided that can be easily used to reconcile data.

- Extracted data is compared and matched with travel agency data to identify missing airline invoices.

- Extracted data can be reconciled with GSTR 2A reports to avail proper input tax credit.

- Airline invoices can be received through auto forward of emails, downloaded from a specified drive or from airline portals. Most of the airline carrier invoice templates are addressed by the process.

- Employee travel expense data files to be provided by corporates for extracting input credit on hotel stay spends. Among the many other scanned invoices in the travel expense file, our system specifically identifies hotel invoices and extracts the tax and related data from them.

- Matching of GSTR 2A reports with the extracted data for specific reports.

- Solution well established and already being provided to leading corporates and Travel Management Companies.

SERVICES OFFERED

- Downloading of invoices from Airline portals

- Parsing / Processing of Airline / Hotel Invoices to provide GST Input Tax Credit Data

- Matching of extracted data to Travel Agency data to find missing invoices

- Provide parsed data in agreed Excel formats

- Renaming of airline files to invoice# and storage for future use

- Matching of GSTR 2A report with extracted data and providing specified reports

- Data retention on cloud as per agreed term